Welcome to our comprehensive guide on invoicing software for small business owners. In today’s fast-paced and digital world, having a reliable invoicing system is crucial for the success of any small business. It not only helps in organizing your finances but also helps in maintaining good relationships with clients by providing timely and accurate invoices.

Toc

- 1. Introduction to Invoicing Software

- 2. Benefits of Invoicing Software for Small Businesses

- 3. Choosing the Right Invoicing Software for Your Small Business

- 4. Comparison of some Invoicing Software

- 5. Case Studies and Testimonials

- 6. FAQs

- 6.1. What is invoicing software?

- 6.2. Do I need to have accounting knowledge to use invoicing software?

- 6.3. Are there free invoicing software options available?

- 6.4. Can invoicing software handle international clients?

- 6.5. How secure is my data with online invoicing software?

- 6.6. Can I integrate invoicing software with other tools?

- 6.7. What should I consider when choosing invoicing software?

- 6.8. Is there a trial period available for invoicing software?

- 7. Conclusion

In this guide, we will cover everything you need to know about invoicing software – from its benefits and features to choosing the right one for your business. So let’s get started!

Introduction to Invoicing Software

In the fast-paced world of small business, efficiency is key. One area where you can significantly streamline operations is your invoicing process. Invoicing software offers a range of features designed to simplify and enhance the way you manage your billing. From automating recurring invoices to providing detailed financial insights, invoicing software can be a game-changer for small business owners. In this guide, we will explore everything you need to know about invoicing software and how it can benefit your small business.

What is Invoicing Software?

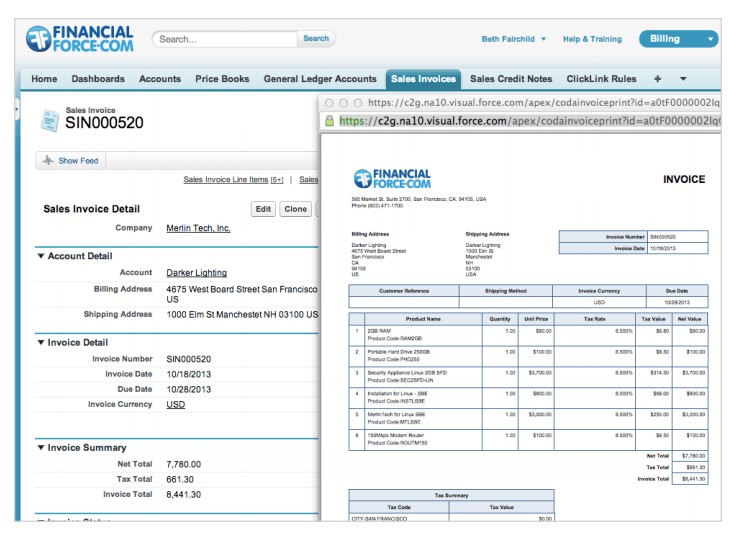

Invoicing software is a digital tool that helps businesses create, send, and track invoices. It streamlines the entire billing process by automating tasks such as invoice creation, payment reminders, and reporting. With invoicing software, you can easily generate professional-looking invoices with just a few clicks. You can also customize your invoices to reflect your brand and include important details such as taxes, discounts, and due dates. With the ability to track payments and send reminders, invoicing software allows you to stay on top of your finances and maintain a healthy cash flow.

How Invoicing Software Works

Invoicing software typically works by allowing you to create, send, and track invoices from a single platform. You start by setting up your client information and invoice templates. Once that’s done, you can generate invoices with just a few clicks. The software will handle the rest, from sending the invoice to tracking payments and sending reminders for overdue invoices. Most invoicing software also offers reporting and analytics features, giving you valuable insights into your business’s financial health.

Benefits of Invoicing Software for Small Businesses

Now that we have a basic understanding of what invoicing software is, let’s explore the benefits it can offer to small businesses:

1. Time-Saving Automation

Small business owners are often juggling multiple tasks at once, making it challenging to find time for administrative tasks like invoicing. Invoicing software automates most aspects of the billing process, freeing up your time to focus on other critical business operations.

2. Improved Accuracy and Professionalism

Manual invoicing can lead to errors, which can be costly for your business. Invoicing software eliminates the risk of human error by automating calculations and ensuring that all relevant information is included in the invoice. It also offers professional-looking templates that can make a positive impression on clients.

3. Faster Payments

Invoicing software allows you to send invoices instantly, reducing the time it takes for your clients to receive them. With features like online payment options, you can also speed up the payment process and improve cash flow for your business.

4. Better Financial Management

With invoicing software, you can access detailed financial reports and analytics in real-time. This allows you to keep track of your income, expenses, and outstanding payments, providing valuable insights into the financial health of your business.

Choosing the Right Invoicing Software for Your Small Business

Although there are many benefits to using invoicing software, it’s essential to choose the right one for your business. Here are some factors to consider when making your decision:

1. Features

Before selecting invoicing software, make a comprehensive list of features that are essential for your business operations. Some common features to look for include invoice customization, which allows you to add your own branding and logos; recurring invoicing, which is useful for subscription-based services; payment tracking to easily monitor outstanding balances and received payments, and robust reporting capabilities to generate insightful financial reports. Additionally, consider features like multi-currency support if you deal with international clients, and automated reminders to follow up on overdue invoices.

2. User-Friendly Interface

Invoicing software should be intuitive and easy to use to ensure a smooth transition and minimize the time spent on training. Look for software that offers a user-friendly interface with simple navigation, clear instructions, and helpful tooltips. A well-designed dashboard can help you quickly access the most important functions, such as creating a new invoice, tracking payments, and generating reports. The goal is to choose software that enhances efficiency without a steep learning curve.

3. Integration Options

If you’re already using other tools or software for your business operations, ensure the invoicing software can integrate with them seamlessly. This includes accounting software, customer relationship management (CRM) systems, and payment gateways. Seamless integration will save you time and effort in manually transferring data between different systems, reducing the risk of errors and improving overall workflow efficiency. Check if the software supports API connections or has pre-built integrations with popular business tools you already use.

4. Pricing Plans

While most invoicing software offers a free trial, it’s essential to consider the long-term pricing plans before making a decision. Evaluate if the software provides affordable pricing options based on your business’s needs and budget. Look for scalable plans that can grow with your business, and pay attention to any hidden fees or additional costs for premium features. Consider if the software offers discounts for annual subscriptions or multiple user accounts. Balancing cost with value is crucial to ensure you get the best return on investment.

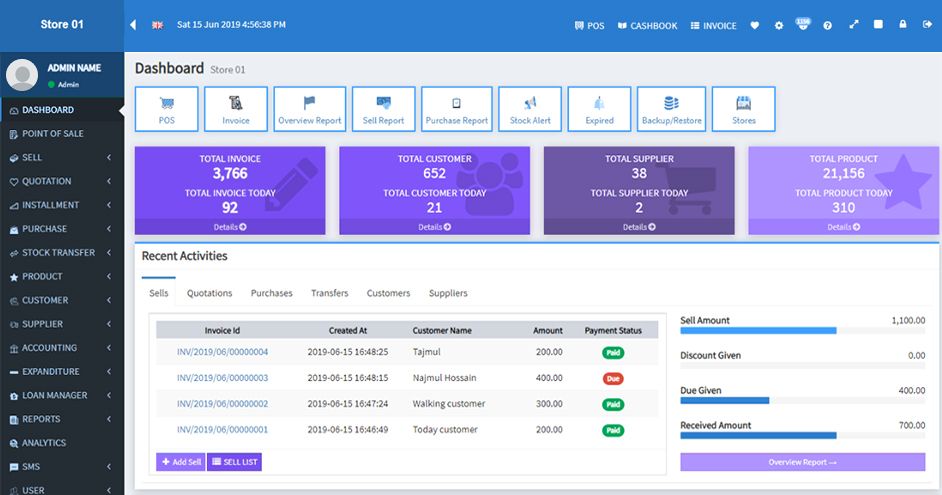

Comparison of some Invoicing Software

Detailed Comparison of Top Invoicing Software

To help you make an informed decision, we have compared some of the most popular invoicing software available today. Below is a detailed comparison of FreshBooks, QuickBooks, Wave, and Zoho Invoice:

FreshBooks

FreshBooks is widely known for its user-friendly interface and robust feature set, making it an excellent choice for small businesses and freelancers. Some of its key features include:

- Invoice Customization: FreshBooks allows you to create and send highly customizable and professional-looking invoices.

- Automated Expense Tracking: The software automatically tracks expenses and categorizes them for easy accounting.

- Time Tracking: FreshBooks offers time tracking, helping you bill clients accurately for hours worked.

- Integration: It integrates seamlessly with a variety of apps, such as PayPal, Stripe, and G Suite.

- Pricing: Plans start at $15 per month, with a free trial available.

QuickBooks

QuickBooks is a comprehensive accounting solution that includes advanced invoicing features. It is ideal for small to medium-sized businesses that need more than just invoicing. Notable features include:

- Invoice Management: QuickBooks provides tools for creating, sending, and managing invoices efficiently.

- Detailed Reports: The software offers extensive reporting capabilities, giving you insights into your business’s financial status.

- Payroll Features: Unlike many other invoicing tools, QuickBooks includes payroll management options.

- Integration: It integrates with numerous third-party applications, such as Salesforce, Shopify, and more.

- Pricing: Pricing starts at $25 per month, with various plans and a 30-day free trial.

Wave

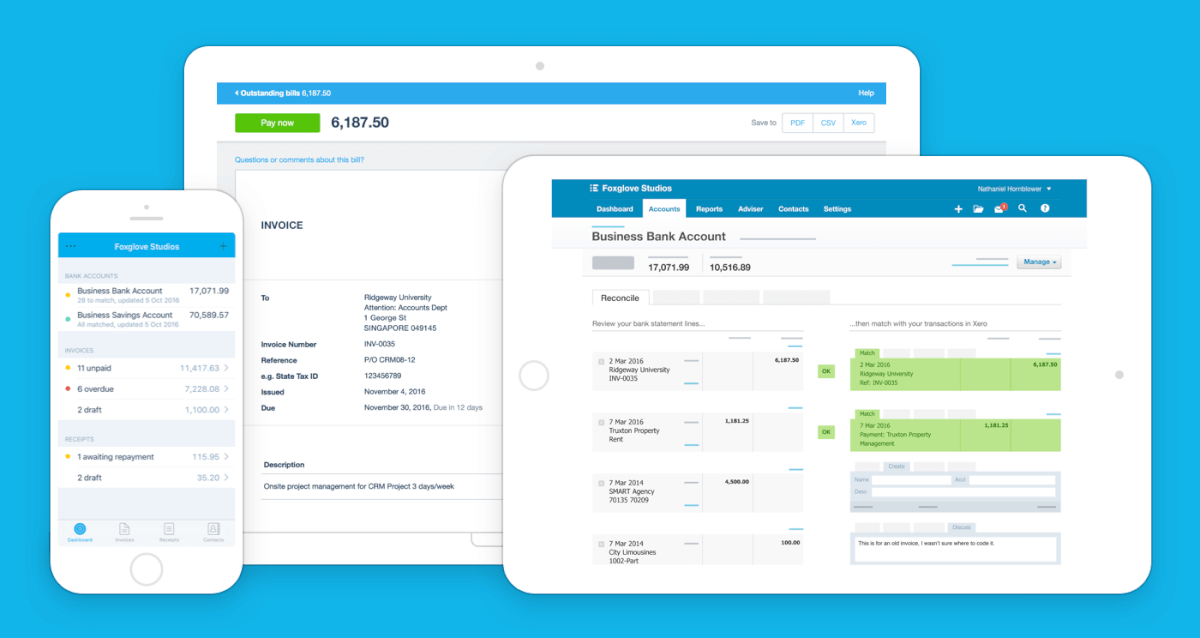

Wave is a free invoicing and accounting tool that is particularly popular among freelancers and small businesses with tight budgets. Despite being free, Wave offers an array of features including:

- Professional Invoicing: Wave enables you to create branded and professional invoices with ease.

- Automated Reminders: The software can send automatic reminders for overdue invoices, helping you get paid faster.

- Receipts and Payments: Wave allows you to scan receipts and connect your bank accounts for seamless payment tracking.

- Integration: Wave integrates with payment processors like PayPal and Stripe.

- Pricing: Completely free for the core invoicing and accounting features. Additional paid services are available.

Zoho Invoice

Zoho Invoice is part of the Zoho suite of business tools and is designed to cater to small and medium-sized businesses. Some of its key features include:

- Customizable Templates: Zoho Invoice offers a variety of customizable templates to fit your brand.

- Multi-Language and Multi-Currency Support: This feature makes it perfect for businesses that operate globally.

- Automated Workflows: The software allows you to automate repetitive tasks such as sending invoices and reminders.

- Integration: It integrates well with other Zoho applications and various third-party apps.

- Pricing: Plans start at $9 per month, with a free tier available for businesses with fewer than five clients.

Summarizing table of Top invoicing softwares

To help you get started, here’s a comparison of some popular invoicing software for small businesses:

To help you get started, here’s a comparison of some popular invoicing software for small businesses:

| Software | Features | Price Range |

|---|---|---|

| FreshBooks | Customizable invoices, time tracking, expense management, reporting and analytics | $15/month – $50/month |

| QuickBooks | Invoice customization, bank reconciliation, inventory tracking, reporting and analytics | $25/month – $150/month |

| Wave | Unlimited invoicing, receipt scanning, expense tracking, reporting and analytics | Free |

| Zoho Invoice | Customizable invoices, recurring invoicing, time tracking, reporting and analytics | $9/month – $29/month |

Case Studies and Testimonials

To get a better understanding of how these invoicing software work in real-life scenarios, here are some case studies and testimonials from businesses that have used them:

Case Study 1

A local graphic design studio integrated an invoicing software solution and saw a 30% reduction in the time spent on billing. Additionally, the studio experienced a 20% increase in on-time payments from clients. The studio owner credited the software’s automation features and the ability to customize invoices for this improvement.

Testimonial 1

“Using invoicing software has been a game-changer for my small business. Not only has it made the billing process much faster and error-free, but it has also improved our cash flow significantly. We can now track invoices and payments with ease, and clients have responded positively to our professional, branded invoices.” – Jane Doe, Owner of a Photography Business.

Case Study 2

A freelance writer incorporated invoicing software into her business, leading to a 40% increase in monthly billings. The software’s analytics feature provided insights into which clients to focus on for increased profitability, and the automation of overdue reminders improved the collection of outstanding payments.

Testimonial 2

“I can’t imagine running my freelance writing business without invoicing software. It’s not just about sending out invoices; it’s about managing my business better. From creating estimates to tracking expenses and payments, it’s a complete financial management tool tailored to my needs.” – John Smith, Freelance Writer.

FAQs

What is invoicing software?

Invoicing software is a digital tool designed to help businesses create, send, and manage invoices easily and efficiently. These platforms often include additional features such as expense tracking, time tracking, automated reminders, and reporting tools to streamline the billing process.

Do I need to have accounting knowledge to use invoicing software?

No, most invoicing software is designed to be user-friendly and intuitive, requiring minimal accounting knowledge. Many solutions offer tutorials, customer support, and detailed guides to help you get started.

Are there free invoicing software options available?

Yes, there are free options available such as Wave, which offers a robust set of features without any cost. However, additional premium features may be available for a fee.

Can invoicing software handle international clients?

Many invoicing software solutions support multi-language and multi-currency options, making them suitable for businesses that deal with international clients. Zoho Invoice, for example, offers comprehensive global support.

How secure is my data with online invoicing software?

Most reputable invoicing software providers prioritize data security and use encryption protocols, secure servers, and regular security updates to protect your information. Always review the security measures and privacy policies of the software you choose.

Can I integrate invoicing software with other tools?

Yes, many invoicing software solutions offer integrations with other business tools like CRM systems, payment gateways, accounting software, and project management tools. For instance, FreshBooks integrates seamlessly with PayPal, Stripe, and G Suite, among others.

What should I consider when choosing invoicing software?

When choosing invoicing software, consider factors such as ease of use, features, integrations with other tools you use, customer support, scalability, and pricing. Assess your business needs to find a solution that aligns with your requirements.

Is there a trial period available for invoicing software?

Yes, most invoicing software providers offer a free trial period, allowing you to test the features and determine if the software meets your needs. For example, QuickBooks offers a 30-day free trial.

Conclusion

Investing in invoicing software is not just about making your life easier; it’s about enhancing your business’s overall efficiency and professionalism. From streamlining the invoicing process to improving cash flow management, the benefits are numerous and impactful.

Ready to take your invoicing process to the next level? Start by exploring the options mentioned in our comparison chart. Choose the one that best fits your business needs and budget. Don’t forget, many of these software solutions offer free trials, so you can test them out before making a commitment.

For personalized recommendations and further assistance, feel free to book a consultation with our experts. We’re here to help you make the best choice for your business.